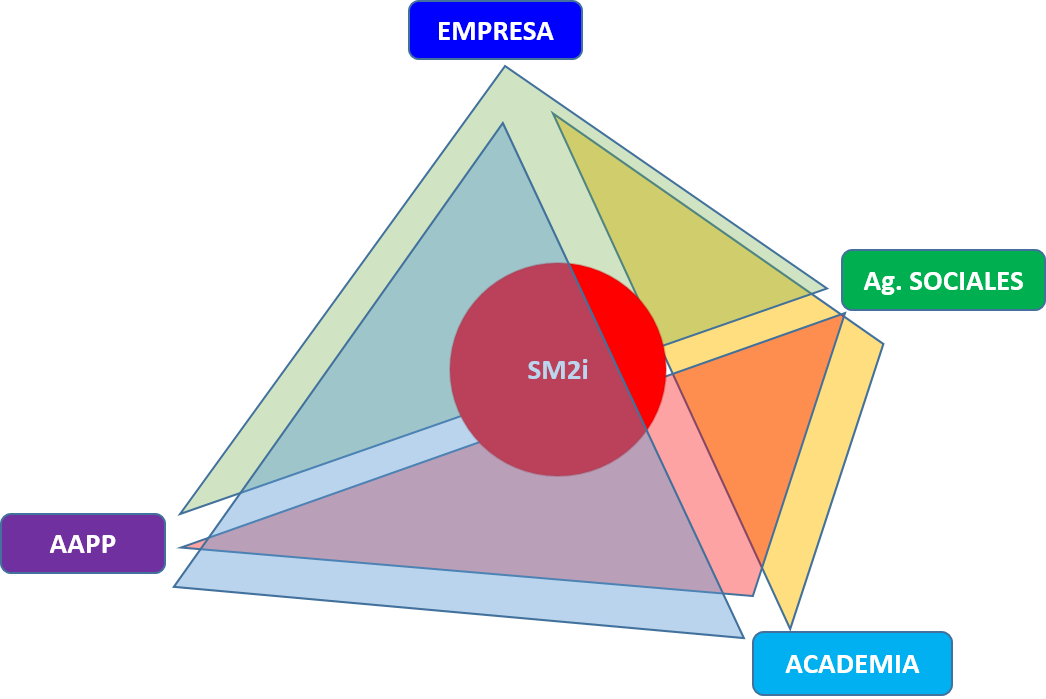

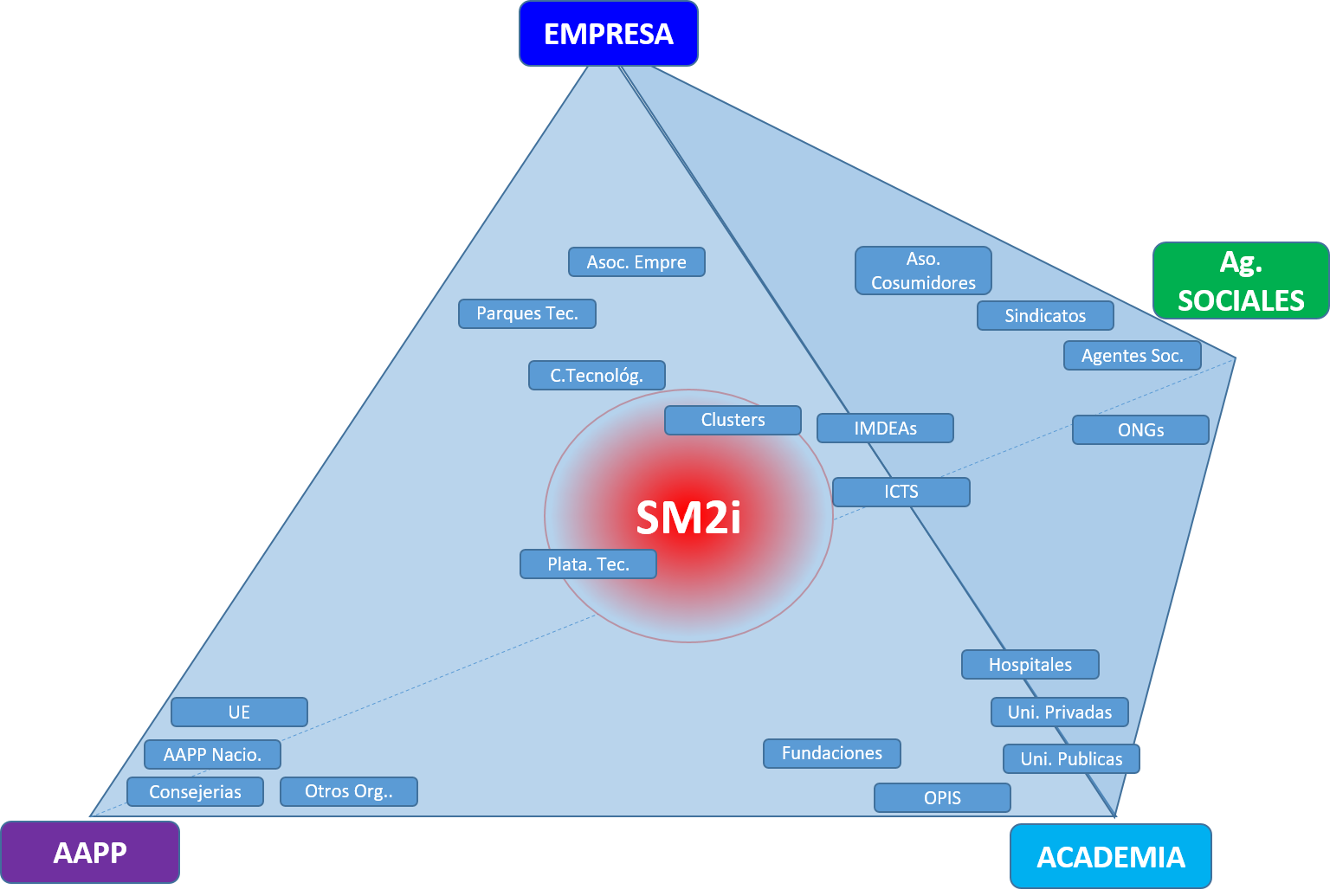

The Madrid R&I Ecosystem and the Quadruple Helix (SM2i – 4H)

The Ecosystem of the Community of Madrid for Research and Innovation (SM2i) is characterized, among other aspects, by being complex, diverse and dynamic. From a conceptual point of view, the agents that make it up would be within the tetrahedron that represents the quadruple helix of the company, academia, administration and society in general.

Within this tetrahedron we can identify the different agents of the em2i ecosystem: Universities, OPIs, Technology Centers, Clusters, Associations, etc.

The Community of Madrid constitutes the largest Spanish research and innovation pole, being a leading region in investment in R&D+i, in employment in R&D and in investment in technological innovation.

From a business point of view, the dynamism of the Community of Madrid is reflected in the number of companies established in Madrid (around 16% of all companies established in Spain) and in the concentration of companies in R+-intensive sectors D with more than 200 employees (31%), also having important acceleration and incubation programs for entrepreneurial businesses and new creation of digital companies with high growth and high potential.

Add, the leadership of the Community of Madrid in Private Centers of Excellence in R&D, with numerous examples of multinationals that have decided to locate their centers of excellence in the region to carry out research activities.

By the type of agents it would be possible to differentiate:

- Entities that generate knowledge (Universities, IMDEAs, OPIs, etc.)

- Entities dedicated to the transfer and application of this knowledge in technologies oriented to its commercial use (Technological C., OTRIs, Laboratories and ICTSs)

- System revitalization entities, and intermediate infrastructures (Technology Parks, business associations, Clusters, Madri+d, etc.)

- Business tissue (companies that generate innovative products and companies that are users or potential users of the R&D results and the R&D Centers of these companies, with special attention to new Technology-Based Companies (TEBs).

ACADEMY and Transfer

We have the densest and most important university system in Spain and one of the largest in Europe. It includes 6 public universities, the UNED and an assortment of universities and private centers:

COMPANY and enhancement

The CM leads Spanish technology exports, with special relevance in some of the most research-intensive sectors, among which it is worth highlighting:

- It is home to one of the largest aerospace clusters in Europe, with half the turnover and employment in the sector in Spain.

- National leadership in engineering (39% of companies / 75% of turnover)

- Headquarters of the main leading Spanish companies in the energy, construction, and transport/logistics sectors.

- Presence of 80% of the leading global biomedical and pharmaceutical companies

- It welcomes the large telecommunications companies in Spain and close to 50% of the leading companies in ICT services.

- The emerging foodtech sector, which is beginning to have a greater weight in the Madrid agri-food sector

- Headquarters of a significant number of international companies

“The state of the Madrid Region startup ecosystem. Startup Radar madri+d Report (2021)” and “Newly created company Radar madri+d – Venture Capital Investment in newly created companies (2021)”; some relevant data:

- Among the 5 largest entrepreneurship centers in Europe. Attractive region for entrepreneurs from other countries.

- Fourth in Europe by number of startups (2.433), behind London, Paris and Berlin, and fifth by number of scaleups (267).

- Madrid startups add up to 32.000 jobs. Since 2019, employment growth has occurred in smaller companies (7,8 employees on average), with a rise of 106%.

- A high number of more than 2.300 startups and scaleups account for most of the value (66%) and employment (54%)

- With an average of 13 employees per company, the Software As A Service (SAAS), Mobility and Education sectors have the largest team size.

- The sectors with the highest growth since 2019 are: Semiconductors, e-commerce, and Dating & Social Network are.

- More than 130 incubators, coworkings, venture builders and company builders, and one of the highest densities of private spaces for start-ups. Its universities, research centers and business schools have more than 30 programs and incubators that support start-up companies with a high scientific and technological content, one of the key elements in considering the region as a Strong Innovator within the European Regional Innovation Scoreboard prepared by the European Union.

- Sectors vs. support entities: the engineering, space, health, or biotechnology sectors are more common in university, IPO, and hospital programs, while business software, marketing, e-commerce, and fintech are more common in public incubators and private.

- 7th place in Europe in number of capital attraction operations (€509 M in 83 operations -2019-) and 9th place in total amount (multiplied by 3,5 the €149 M of five years ago). Even far from London, Berlin, Stockholm or Paris (>3.000 million €/a) it is growing and the evolution of international activity (half of the newly created companies have international sales).

- Startup Sectors: Leader in the ICT space, with one of the highest concentrations of talent in areas such as AI, robotics, 5G, gaming and cybersecurity. A high level of ownership of the technology and innovations they commercialize.

- 7th European place in number of computer developers. High number of university graduates with a high percentage in STEM areas. It is also the third Autonomous Community in percentage of students with university education and vocational training in Spain (54,6%),

- Investment in venture capital. Well positioned after overcoming the fall associated with COVID-19. In 2020, 153 investment operations were carried out in the region in newly created companies for €472 million and only in the first two months of 2021, €643,6 million of investment had already been registered in the region. Looking at the sectors, business software, fintech and e-health stand out for the number of investments (44% of the investments for the year) and for the amount of investment, 5 sectors concentrate 80% of the value: business software, logistics and transport, fintech, e-health and cybersecurity.

PUBLIC ADMINISTRATION

Ministry of Environment, Agriculture and Interior

PAC- DG Agriculture Livestock and Food - “Territorial Annex of the Community of Madrid in the Strategic Plan of Spain for the Common Agrarian Policy 2023-2027 of the European Union”.

NATURA 2000.- DG Biodiversity and Forest Management - “Priority Action Framework (MAP) for NATURA 2000 in the CM” ![]() red_natura_2000_cm_map.pdf

red_natura_2000_cm_map.pdf

DECARBONIZATION. - DG Energy Transition and Circular Economy - “Decarbonization and Environmental Care Plan”![]() towards_a_decarbonized_region_2.pdf

towards_a_decarbonized_region_2.pdf

ENERGY AREA.- "CM Energy Strategy Horizon 2023"

WASTE.- “CM Sustainable Waste Management Strategy"

CIRCULAR ECONOMY.- “Draft Circular Economy Law"

Digitalization Department. Sign in

- Digitalization Strategy 2023-2026. Sign in

Regional Department of Economy, Taxation and Employment

- Madrid Strategy for Employment 2021-2023. View pdf

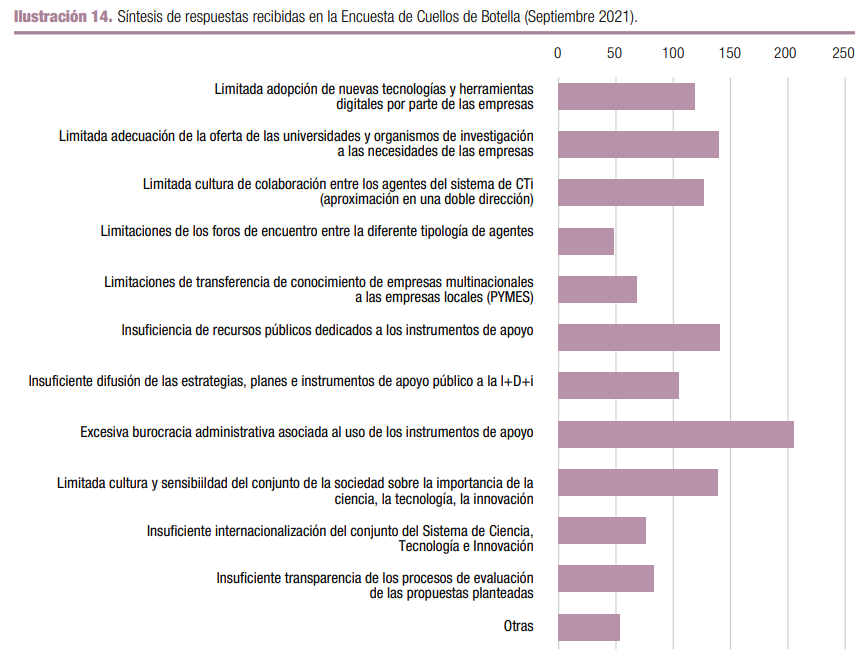

SM2i – Bottlenecks

For the elaboration of the S3 of the CM, a study was carried out to identify the 'bottlenecks' for the dissemination of R&I and digitization. From the results of the Survey (272 responses) it can be deduced that the excessive administrative bureaucracy is perceived as the main challenge (203), followed by the limited adequacy of the university offer (138) and the limited culture and sensitivity of society about the importance of science (138).

SM2i – SWOT Analysis

For the preparation of the S3 of the CM, a study was carried out to identify the main weaknesses, threats, strengths and opportunities (SWOT) of the EM2i, in 6 strategic axes that have been considered priorities:

- People and Capacities,

- Excellent Science,

- Collaboration and Valuation,

- Business leadership,

- Conscious Society

- good governance